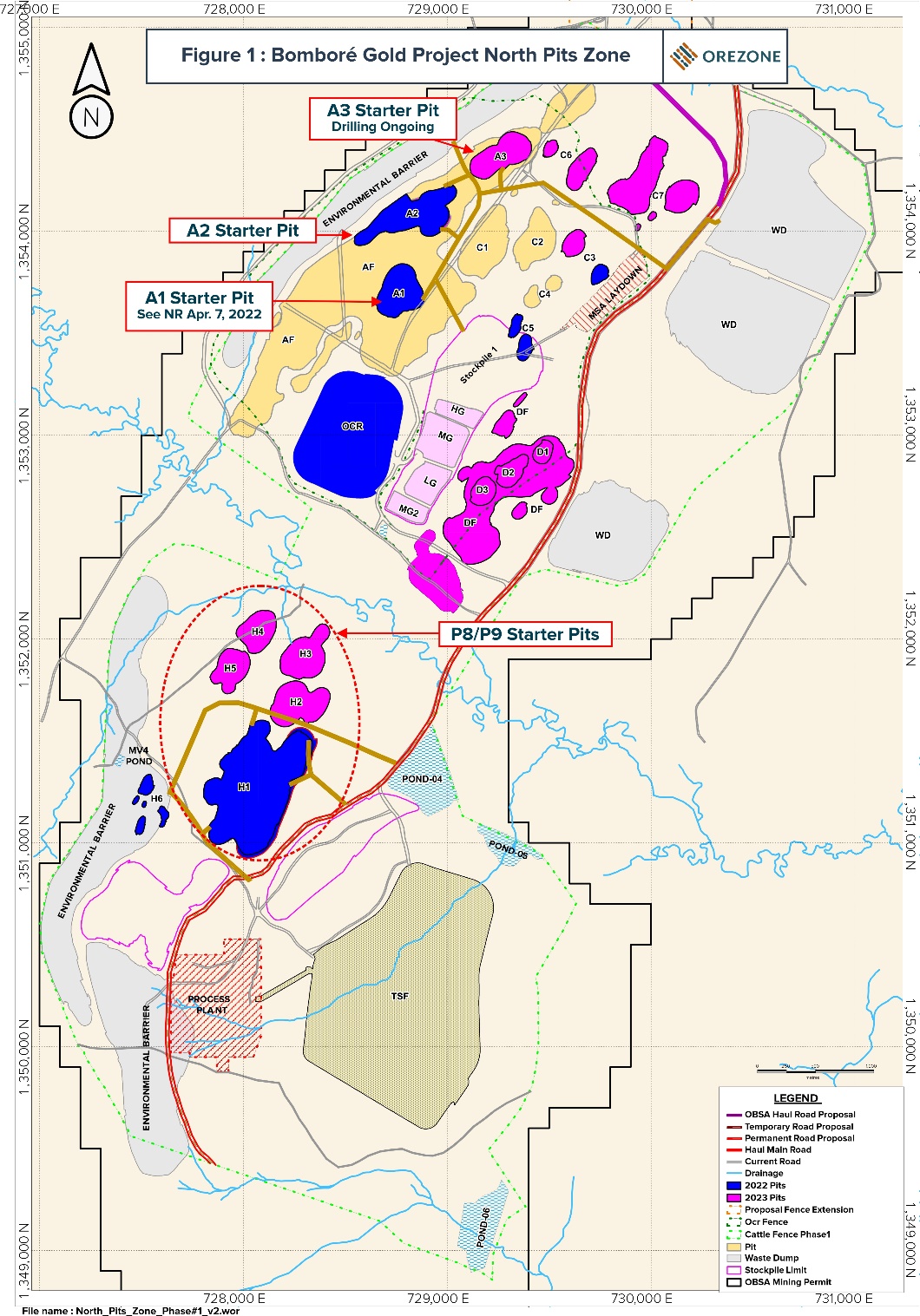

June 9, 2022 – Vancouver, BC - Orezone Gold Corporation (TSX: ORE, OTCQX: ORZCF) (the “Company” or “Orezone”) is pleased to report further assay results from the maiden grade control (“GC”) reverse circulation (“RC”) drill program at the Bomboré Gold Project, located in Burkina Faso. GC drilling to-date is focused on near-surface oxide mineralization within the starter pits located in the northern portion of the mining lease. These starter pits will be the source of higher-grade oxide mill feed for the first year of production and are denoted as A1, A2, A3, H1, H2, and H3 (see Figure 1 below). GC results for Pit A2 are now available and similar to Pit A1 (see news release dated April 7, 2022 for A1 Pit GC results), are very encouraging.

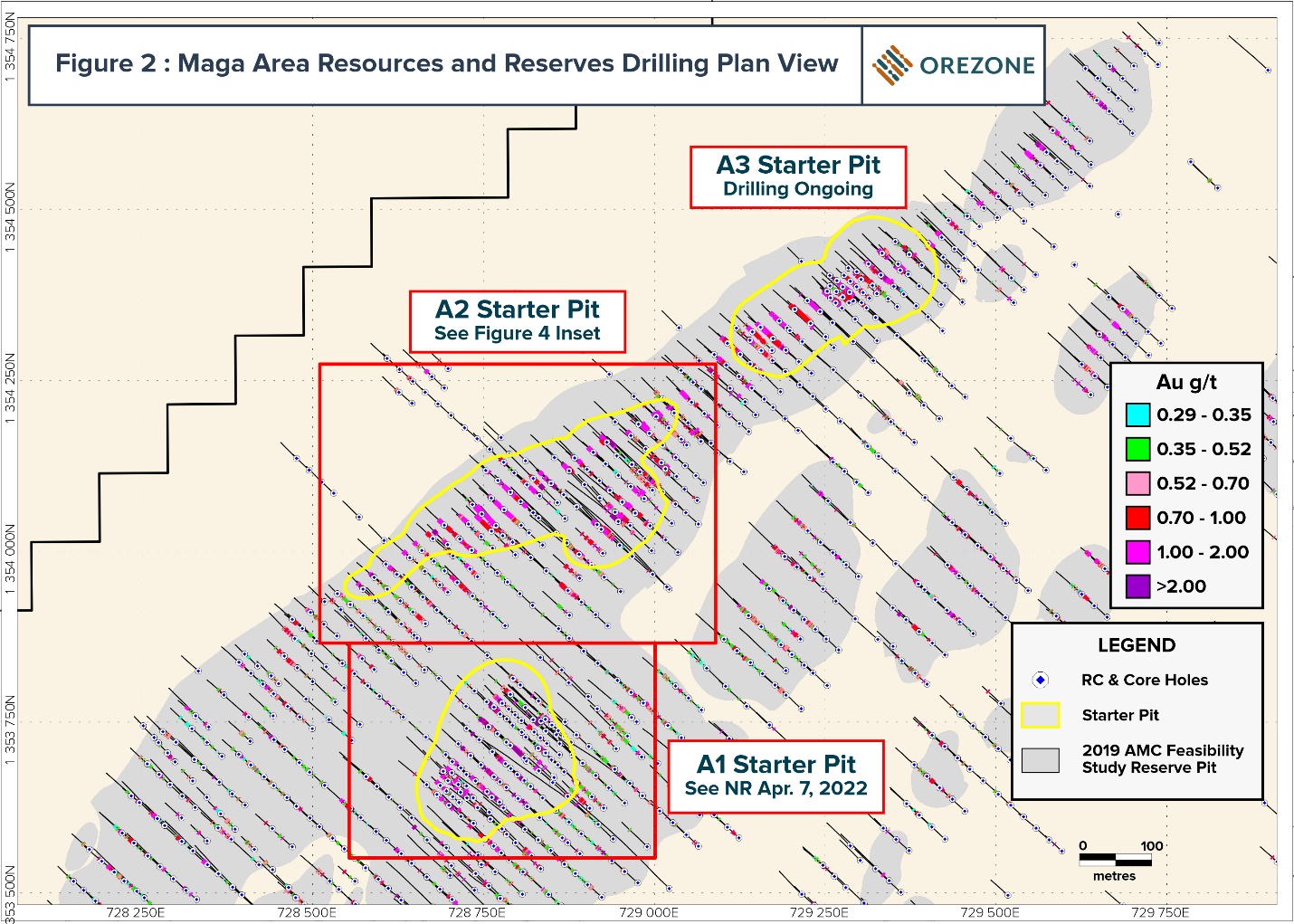

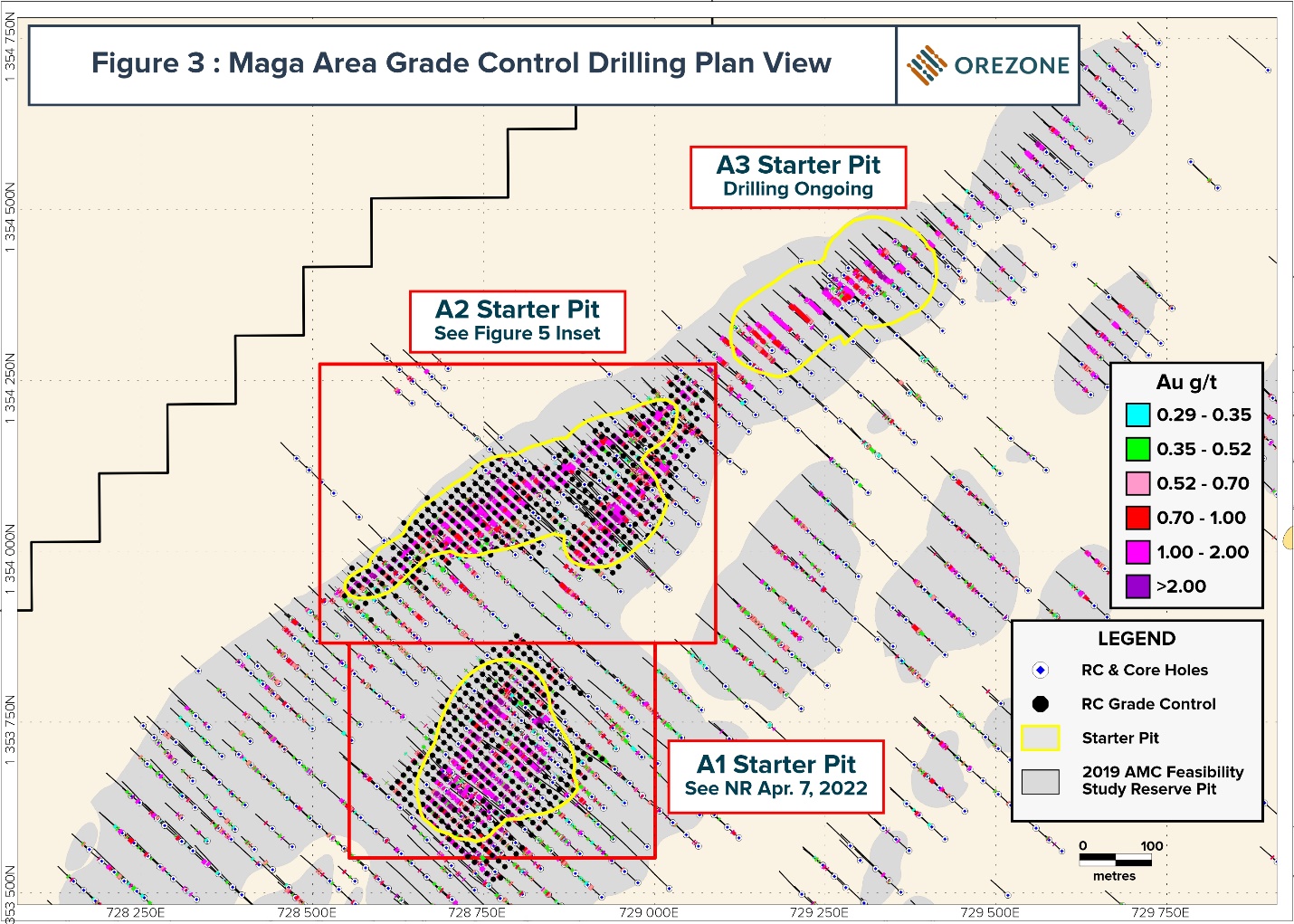

Results have returned several significant thicker high-grade intervals where localized zones of higher grades were intersected in several holes which collared or ended in mineralization. Some of these zones reported remain open in several areas (see Figures 2 and 3).

Drilling Highlights

- 4.00 m of 22.42 g/t Au from 27.00 m

- 31.00 m of 2.30 g/t Au from 0.00 m

- 31.00 m of 2.17 g/t Au from 0.00 m

- 20.00 m of 2.43 g/t Au from 11.00 m

- 18.00 m of 2.61 g/t Au from 13.00 m

- 26.00 m of 1.79 g/t Au from 5.00 m

- 31.00 m of 1.49 g/t Au from 0.00 m

- 31.00 m of 1.48 g/t Au from 0.00 m

- 31.00 m of 1.47 g/t Au from 0.00 m

- 27.00 m of 1.68 g/t Au from 0.00 m

- 2.00 m of 21.98 g/t Au from 10.00 m

- 24.00 m of 1.83 g/t Au from 0.00 m

- 25.00 m of 1.74 g/t Au from 6.00 m

- 11.00 m of 3.79 g/t Au from 17.00 m

- 24.00 m of 1.61 g/t Au from 7.00 m

- 28.00 m of 1.37 g/t Au from 3.00 m

- 18.00 m of 2.08 g/t Au from 13.00 m

- 20.00 m of 1.77 g/t Au from 0.00 m

- 7.00 m of 4.76 g/t Au from 5.00 m

- 17.00 m of 1.92 g/t Au from 0.00 m

- 17.00 m of 1.84 g/t Au from 13.00 m

- 18.00 m of 1.68 g/t Au from 8.00 m

- 18.00 m of 1.63 g/t Au from 13.00 m

- 11.00 m of 2.67 g/t Au from 7.00 m

- 9.00 m of 3.22 g/t Au from 14.00 m

- 18.00 m of 1.53 g/t Au from 3.00 m

- 9.00 m of 2.90 g/t Au from 19.00 m

- 15.00 m of 1.74 g/t Au from 10.00 m

- 10.00 m of 2.56 g/t Au from 21.00 m

- 12.00 m of 2.07 g/t Au from 4.00 m

- 12.00 m of 2.05 g/t Au from 9.00 m

- 10.00 m of 2.40 g/t Au from 21.00 m

- 5.00 m of 4.73 g/t Au from 6.00 m

- 7.00 m of 3.19 g/t Au from 8.00 m

- 5.00 m of 3.60 g/t Au from 0.00 m

- 9.00 m of 1.92 g/t Au from 22.00 m

- 11.00 m of 1.52 g/t Au from 0.00 m

- 6.00 m of 2.73 g/t Au from 5.00 m

- 4.00 m of 3.51 g/t Au from 0.00 m

Patrick Downey, President and CEO stated, “The GC drilling results at the A2 starter pit are extremely robust and have not only confirmed but extended the higher-grade zones within our resource and reserve models for Bomboré. These higher-grade zones are up to 60 m thick with average widths of 15 m to 30 m with ore starting right at surface with several holes ending in mineralization. These zones continue up to the A3 pit and beyond towards the northeast, and we will now expand the GC program to incorporate this additional area. We expect to outline an enlarged higher-grade starter pit that will encompass all of the A1, A2, and A3 pits. The GC program is also continuing at the H1 and H2 higher-grade starter pits in the P8/P9 area located in close proximity to the process plant. Mining from all of these pits will provide better grade oxide ore feed for the first 12 to 15 months of operations. We remain on-time and on-budget for first gold in Q3 of this year and look forward to delivering strong early gold production as supported by these impressive recent and on-going GC results.”

Figure 1: North Pits Plan View

Figure 2: Maga Area Resources and Reserve Drilling Plan View

Figure 3: Maga Area Grade Control Drilling Plan View

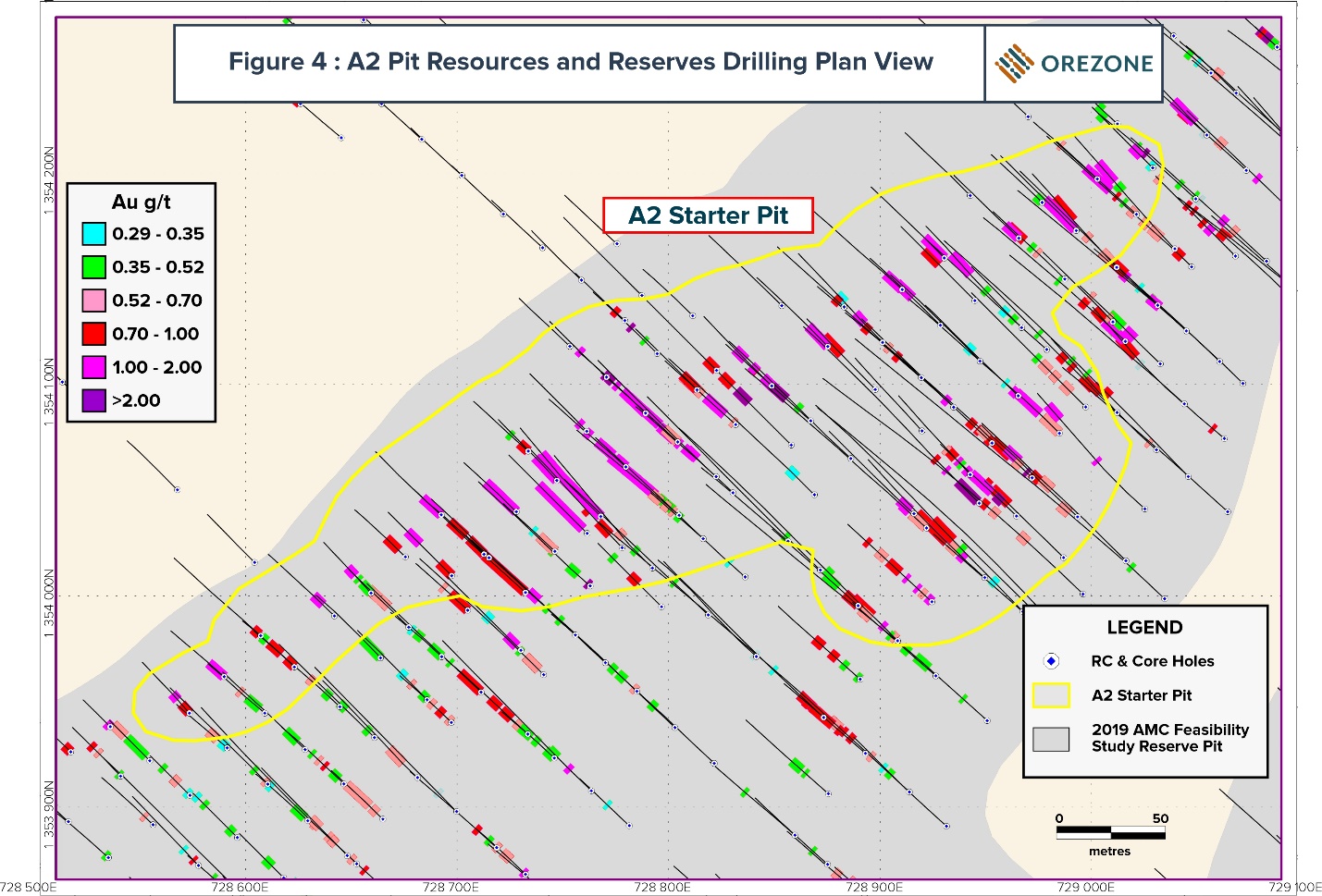

Figure 4: A2 Pit Resources and Reserve Drilling Plan View

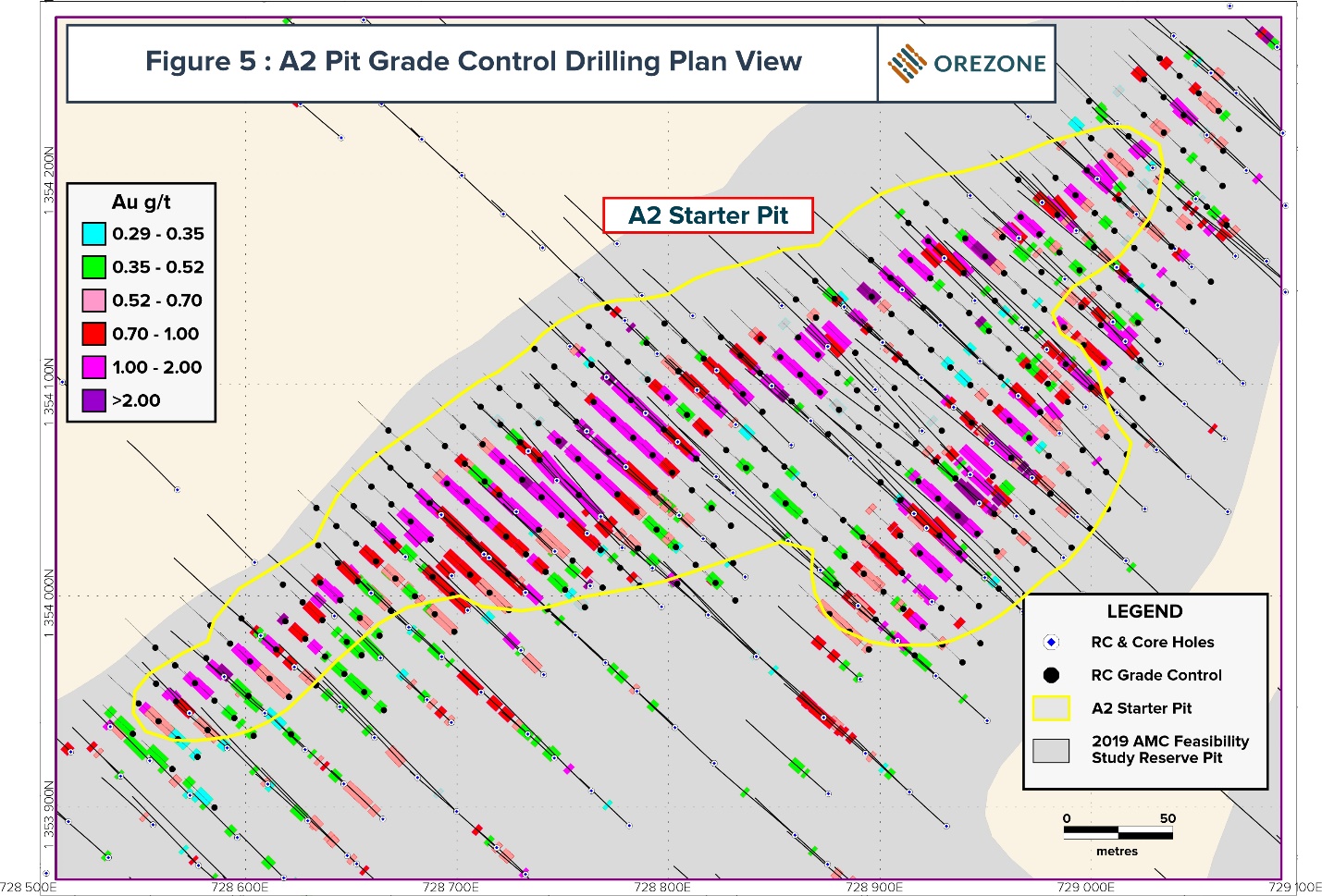

Figure 5: A2 Pit Grade Control Drilling Plan View

Table 1: A2 Starter Pit Drilling Highlights

|

Hole |

From |

To |

Length |

Grade |

|

MAGA-GCA2-0337 |

27.00 |

31.00 |

4.00 |

22.42 |

|

MAGA-GCA2-0254 |

0.00 |

31.00 |

31.00 |

2.30 |

|

MAGA-GCA2-0146 |

0.00 |

31.00 |

31.00 |

2.17 |

|

MAGA-GCA2-0060 |

11.00 |

31.00 |

20.00 |

2.43 |

|

MAGA-GCA2-0132 |

13.00 |

31.00 |

18.00 |

2.61 |

|

MAGA-GCA2-0204 |

5.00 |

31.00 |

26.00 |

1.79 |

|

MAGA-GCA2-0215 |

0.00 |

31.00 |

31.00 |

1.49 |

|

MAGA-GCA2-0236 |

0.00 |

31.00 |

31.00 |

1.48 |

|

MAGA-GCA2-0247 |

0.00 |

31.00 |

31.00 |

1.47 |

|

MAGA-GCA2-0253 |

0.00 |

27.00 |

27.00 |

1.68 |

|

MAGA-GCA2-0343 |

10.00 |

12.00 |

2.00 |

21.98 |

|

MAGA-GCA2-0059 |

0.00 |

24.00 |

24.00 |

1.83 |

|

MAGA-GCA2-0216 |

6.00 |

31.00 |

25.00 |

1.74 |

|

MAGA-GCA2-0328 |

17.00 |

28.00 |

11.00 |

3.79 |

|

MAGA-GCA2-0271 |

7.00 |

31.00 |

24.00 |

1.61 |

|

MAGA-GCA2-0263 |

3.00 |

31.00 |

28.00 |

1.37 |

|

MAGA-GCA2-0163 |

13.00 |

31.00 |

18.00 |

2.08 |

|

MAGA-GCA2-0145 |

0.00 |

20.00 |

20.00 |

1.77 |

|

MAGA-GCA2-0255 |

0.00 |

31.00 |

31.00 |

1.14 |

|

MAGA-GCA2-0094 |

5.00 |

12.00 |

7.00 |

4.76 |

|

MAGA-GCA2-0270 |

0.00 |

17.00 |

17.00 |

1.92 |

|

MAGA-GCA2-0235 |

0.00 |

24.00 |

24.00 |

1.36 |

|

MAGA-GCA2-0027 |

13.00 |

30.00 |

17.00 |

1.84 |

|

MAGA-GCA2-0124 |

0.00 |

21.00 |

21.00 |

1.49 |

|

MAGA-GCA2-0077 |

0.00 |

21.00 |

21.00 |

1.48 |

|

MAGA-GCA2-0033 |

8.00 |

26.00 |

18.00 |

1.68 |

|

MAGA-GCA2-0272 |

13.00 |

31.00 |

18.00 |

1.63 |

|

MAGA-GCA2-0213 |

7.00 |

18.00 |

11.00 |

2.67 |

|

MAGA-GCA2-0095 |

14.00 |

23.00 |

9.00 |

3.22 |

|

MAGA-GCA2-0120 |

3.00 |

21.00 |

18.00 |

1.53 |

|

MAGA-GCA2-0331 |

19.00 |

28.00 |

9.00 |

2.90 |

|

MAGA-GCA2-0286 |

10.00 |

25.00 |

15.00 |

1.74 |

|

MAGA-GCA2-0045 |

21.00 |

31.00 |

10.00 |

2.56 |

|

MAGA-GCA2-0157 |

0.00 |

17.00 |

17.00 |

1.50 |

|

MAGA-GCA2-0137 |

1.00 |

19.00 |

18.00 |

1.39 |

|

MAGA-GCA2-0203 |

4.00 |

16.00 |

12.00 |

2.07 |

|

MAGA-GCA2-0044 |

9.00 |

21.00 |

12.00 |

2.05 |

|

MAGA-GCA2-0288 |

11.00 |

31.00 |

20.00 |

1.21 |

|

MAGA-GCA2-0167 |

10.00 |

28.00 |

18.00 |

1.33 |

|

MAGA-GCA2-0214 |

21.00 |

31.00 |

10.00 |

2.40 |

|

MAGA-GCA2-0055 |

13.00 |

31.00 |

18.00 |

1.32 |

|

MAGA-GCA2-0340 |

6.00 |

11.00 |

5.00 |

4.73 |

|

MAGA-GCA2-0227 |

0.00 |

21.00 |

21.00 |

1.11 |

|

MAGA-GCA2-0102 |

8.00 |

26.00 |

18.00 |

1.29 |

|

MAGA-GCA2-0152 |

13.00 |

25.00 |

12.00 |

1.86 |

|

MAGA-GCA2-0205 |

8.00 |

15.00 |

7.00 |

3.19 |

|

MAGA-GCA2-0070 |

0.00 |

20.00 |

20.00 |

1.10 |

|

MAGA-GCA2-0144 |

0.00 |

18.00 |

18.00 |

1.20 |

|

MAGA-GCA2-0112 |

6.00 |

21.00 |

15.00 |

1.34 |

|

MAGA-GCA2-0237 |

18.00 |

31.00 |

13.00 |

1.54 |

|

MAGA-GCA2-0327 |

3.00 |

16.00 |

13.00 |

1.53 |

|

MAGA-GCA2-0294 |

0.00 |

11.00 |

11.00 |

1.74 |

|

MAGA-GCA2-0066 |

14.00 |

29.00 |

15.00 |

1.26 |

|

MAGA-GCA2-0280 |

17.00 |

26.00 |

9.00 |

2.08 |

|

MAGA-GCA2-0273 |

11.00 |

29.00 |

18.00 |

1.03 |

|

MAGA-GCA2-0166 |

0.00 |

11.00 |

11.00 |

1.66 |

|

MAGA-GCA2-0162 |

0.00 |

10.00 |

10.00 |

1.81 |

|

MAGA-GCA2-0249 |

0.00 |

5.00 |

5.00 |

3.60 |

|

MAGA-GCA2-0117 |

13.00 |

24.00 |

11.00 |

1.64 |

|

MAGA-GCA2-0308 |

8.00 |

16.00 |

8.00 |

2.24 |

|

MAGA-GCA2-0179 |

9.00 |

31.00 |

22.00 |

0.81 |

|

MAGA-GCA2-0226 |

0.00 |

14.00 |

14.00 |

1.26 |

|

MAGA-GCA2-0088 |

0.00 |

9.00 |

9.00 |

1.93 |

|

MAGA-GCA2-0138 |

6.00 |

19.00 |

13.00 |

1.34 |

|

MAGA-GCA2-0282 |

8.00 |

23.00 |

15.00 |

1.16 |

|

MAGA-GCA2-0336 |

12.00 |

19.00 |

7.00 |

2.47 |

|

MAGA-GCA2-0256 |

22.00 |

31.00 |

9.00 |

1.92 |

|

MAGA-GCA2-0285 |

0.00 |

11.00 |

11.00 |

1.52 |

|

MAGA-GCA2-0323 |

5.00 |

11.00 |

6.00 |

2.73 |

|

MAGA-GCA2-0147 |

17.00 |

28.00 |

11.00 |

1.46 |

|

MAGA-GCA2-0226 |

20.00 |

27.00 |

7.00 |

2.29 |

|

MAGA-GCA2-0156 |

6.00 |

19.00 |

13.00 |

1.23 |

|

MAGA-GCA2-0081 |

26.00 |

31.00 |

5.00 |

3.17 |

|

MAGA-GCA2-0208 |

8.00 |

21.00 |

13.00 |

1.21 |

|

MAGA-GCA2-0138 |

23.00 |

31.00 |

8.00 |

1.96 |

|

MAGA-GCA2-0078 |

21.00 |

30.00 |

9.00 |

1.74 |

|

MAGA-GCA2-0172 |

12.00 |

26.00 |

14.00 |

1.10 |

|

MAGA-GCA2-0281 |

15.00 |

31.00 |

16.00 |

0.96 |

|

MAGA-GCA2-0187 |

13.00 |

27.00 |

14.00 |

1.08 |

|

MAGA-GCA2-0234 |

14.00 |

20.00 |

6.00 |

2.52 |

|

MAGA-GCA2-0292 |

0.00 |

12.00 |

12.00 |

1.26 |

|

MAGA-GCA2-0040 |

0.00 |

16.00 |

16.00 |

0.94 |

|

MAGA-GCA2-0103 |

21.00 |

31.00 |

10.00 |

1.49 |

|

MAGA-GCA2-0200 |

18.00 |

31.00 |

13.00 |

1.10 |

|

MAGA-GCA2-0335 |

0.00 |

4.00 |

4.00 |

3.51 |

|

MAGA-GCA2-0309 |

21.00 |

30.00 |

9.00 |

1.55 |

|

MAGA-GCA2-0234 |

0.00 |

9.00 |

9.00 |

1.51 |

|

MAGA-GCA2-0313 |

9.00 |

17.00 |

8.00 |

1.68 |

|

MAGA-GCA2-0217 |

20.00 |

31.00 |

11.00 |

1.22 |

|

MAGA-GCA2-0318 |

6.00 |

14.00 |

8.00 |

1.67 |

|

MAGA-GCA2-0316 |

0.00 |

5.00 |

5.00 |

2.65 |

|

MAGA-GCA2-0113 |

26.00 |

31.00 |

5.00 |

2.62 |

|

MAGA-GCA2-0189 |

17.00 |

31.00 |

14.00 |

0.94 |

|

MAGA-GCA2-0279 |

0.00 |

7.00 |

7.00 |

1.79 |

|

MAGA-GCA2-0008 |

0.00 |

7.00 |

7.00 |

1.79 |

|

MAGA-GCA2-0186 |

2.00 |

16.00 |

14.00 |

0.89 |

|

MAGA-GCA2-0109 |

12.00 |

18.00 |

6.00 |

2.06 |

|

MAGA-GCA2-0076 |

0.00 |

9.00 |

9.00 |

1.37 |

|

MAGA-GCA2-0214 |

0.00 |

14.00 |

14.00 |

0.87 |

|

MAGA-GCA2-0287 |

14.00 |

21.00 |

7.00 |

1.75 |

|

MAGA-GCA2-0120 |

26.00 |

31.00 |

5.00 |

2.40 |

|

MAGA-GCA2-0145 |

22.00 |

31.00 |

9.00 |

1.27 |

|

MAGA-GCA2-0101 |

1.00 |

10.00 |

9.00 |

1.25 |

|

MAGA-GCA2-0305 |

9.00 |

18.00 |

9.00 |

1.25 |

|

MAGA-GCA2-0139 |

22.00 |

31.00 |

9.00 |

1.22 |

|

MAGA-GCA2-0089 |

23.00 |

28.00 |

5.00 |

2.16 |

|

MAGA-GCA2-0274 |

5.00 |

12.00 |

7.00 |

1.54 |

|

MAGA-GCA2-0125 |

16.00 |

24.00 |

8.00 |

1.33 |

|

MAGA-GCA2-0063 |

0.00 |

9.00 |

9.00 |

1.17 |

|

MAGA-GCA2-0298 |

0.00 |

14.00 |

14.00 |

0.74 |

|

MAGA-GCA2-0074 |

0.00 |

6.00 |

6.00 |

1.67 |

* True widths for A2 grade control drilling are approximately 85% of drilled lengths

Grade Control Drilling Program

Drilling was completed on a 12.5 m by 12.5 m pattern over the A2 starter pit to bench elevation 255 m. The GC program has confirmed the widths of the high-grade gold ore zones, generally 15 m to 30 m wide and in some places, up to 60 m wide within the A2 starter pit. The majority of cross-sections have returned significant zones of thick high-grade oxide gold results with several collaring and/or ending in mineralization. The oxide starter pit at A2 is expected to have an average depth of 30 m to 35 m along the main mineralized zone.

These results provide further confidence in both the widths and tenors of mineralization present at A2 prior to the commencement of scheduled mining and processing.

Drilling on-site continues with the RC drill rig now operating at the H1 and H2 open pit areas. Upon completion, the rig will return to expand the GC program from A2 towards the A3 pit to the northeast and towards the A1 pit to the southwest.

A summary plan map of the resource drilling results in the A2 pit prior to the GC drilling is presented in Figure 4 while Figure 5 shows the same area updated with the successful GC drilling results.

About Orezone Gold Corporation

Orezone Gold Corporation (TSX: ORE OTCQX: ORZCF) is a Canadian development company which owns a 90% interest in Bomboré, one of the largest undeveloped gold deposits in Burkina Faso.

The 2019 feasibility study highlights Bomboré as an attractive shovel-ready gold project with forecasted annual gold production of 118,000 ounces over a 13+ year mine life at an All-In Sustaining Cost of US$730/ounce with an after-tax payback period of 2.5 years at an assumed gold price of US$1,300/ounce. Bomboré is underpinned by a mineral resource base in excess of 5 million gold ounces and possesses significant expansion potential. Orezone is fully funded to bring Bomboré into production with the first gold pour scheduled for Q3-2022.

Patrick Downey

President and Chief Executive Officer

Vanessa Pickering

Manager, Investor Relations

Tel: 1 778 945 8977 / Toll Free: 1 888 673 0663

info@orezone.com / www.orezone.com

Qualified Person

Dr. Pascal Marquis, Geo., Senior VP Exploration is the Qualified Person who has approved the scientific and technical information in this news release.

QA/QC

The grade control program mineralized intervals are based on a lower cut-off grade of 0.28 g/t Au, a minimal width of 4.00 m and up to a maximum of 3.0 m of dilution being included. The true width of the mineralization is approximately 85% of the drilled length. The A2 Pit grade control samples were collected by employees of Orezone Bomboré SA (“OBSA”), Orezone’s 90% owned subsidiary that owns the Project, using the Orezone Reverse Circulation (RC) rig equipped with a Metzke automatic sampler. The average weight of the samples collected was 2.1 kg. All samples from this program were dried and pulverized at the OBSA sample preparation site facility operated by SGS Burkina Faso SA. A 1 kg aliquot was analyzed for leachable gold by bottle-roll cyanidation using a LeachWell TM catalyst at BIGS Global Burkina Sarl in Ouagadougou.

Orezone employs a rigorous Quality Control Program including a minimum of 10% standards, blanks, and duplicates.

For further information please contact Orezone at +1 (778) 9458977 or visit the Company’s website at www.orezone.com.

The Toronto Stock Exchange neither approves nor disapproves the information contained in this news release.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain information that may constitute “forward-looking information” within the meaning of applicable Canadian Securities laws and “forward-looking statements” within the meaning of applicable U.S. securities laws (together, “forward-looking statements”). Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "potential", "possible" and other similar words, or statements that certain events or conditions "may", "will", "could", or "should" occur. Forward-looking statements in this press release include, but are not limited to, statements with respect to future grade control drilling, Bomboré project being fully funded to production and projected first gold by Q3-2022.

All such forward-looking statements are based on certain assumptions and analyses made by management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management and the qualified persons believe are appropriate in the circumstances.

All forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements including, but not limited to, delays caused by the COVID-19 pandemic, terrorist or other violent attacks, the failure of parties to contracts to honour contractual commitments, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts to perform as agreed; social or labour unrest; changes in commodity prices; unexpected failure or inadequacy of infrastructure, the possibility of project cost overruns or unanticipated costs and expenses, accidents and equipment breakdowns, political risk, unanticipated changes in key management personnel and general economic, market or business conditions, the failure of exploration programs, including drilling programs, to deliver anticipated results and the failure of ongoing and uncertainties relating to the availability and costs of financing needed in the future, and other factors described in the Company's most recent annual information form and management discussion and analysis filed on SEDAR on www.sedar.com. Readers are cautioned not to place undue reliance on forward-looking statements.

Although the forward-looking statements contained in this press release are based upon what management of the Company believes are reasonable assumptions, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this press release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the Company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this press release.